Navigating Your 'Fecha De Corte': Essential Dates For Finance & Immigration

Table of Contents

- Understanding "Fecha de Corte": A Core Concept

- The "Fecha de Corte" in Credit Cards: Mastering Your Money

- The "Fecha de Corte" in Immigration Cases: Your Legal Lifeline

- Why Understanding "Fecha de Corte" Matters: Financial Health and Legal Compliance

- Expert Tips for Managing Key Dates

- Conclusion: Empowering Yourself with Knowledge

Understanding "Fecha de Corte": A Core Concept

At its heart, a "fecha de corte" is simply a cut-off date – a specific point in time that marks the end of a period for a particular action or calculation. While the literal translation is straightforward, its application varies significantly depending on the context. In the realm of personal finance, particularly with credit cards, it defines the end of your billing cycle. In legal contexts, especially immigration, it signifies a crucial deadline for an appearance or a specific action. The essence of the "fecha de corte" lies in its definitive nature. It's the moment when a snapshot is taken, a calculation is made, or a period concludes, setting the stage for subsequent actions or obligations. Grasping this fundamental concept is the first step toward effectively managing your responsibilities, whether they are financial or legal.The "Fecha de Corte" in Credit Cards: Mastering Your Money

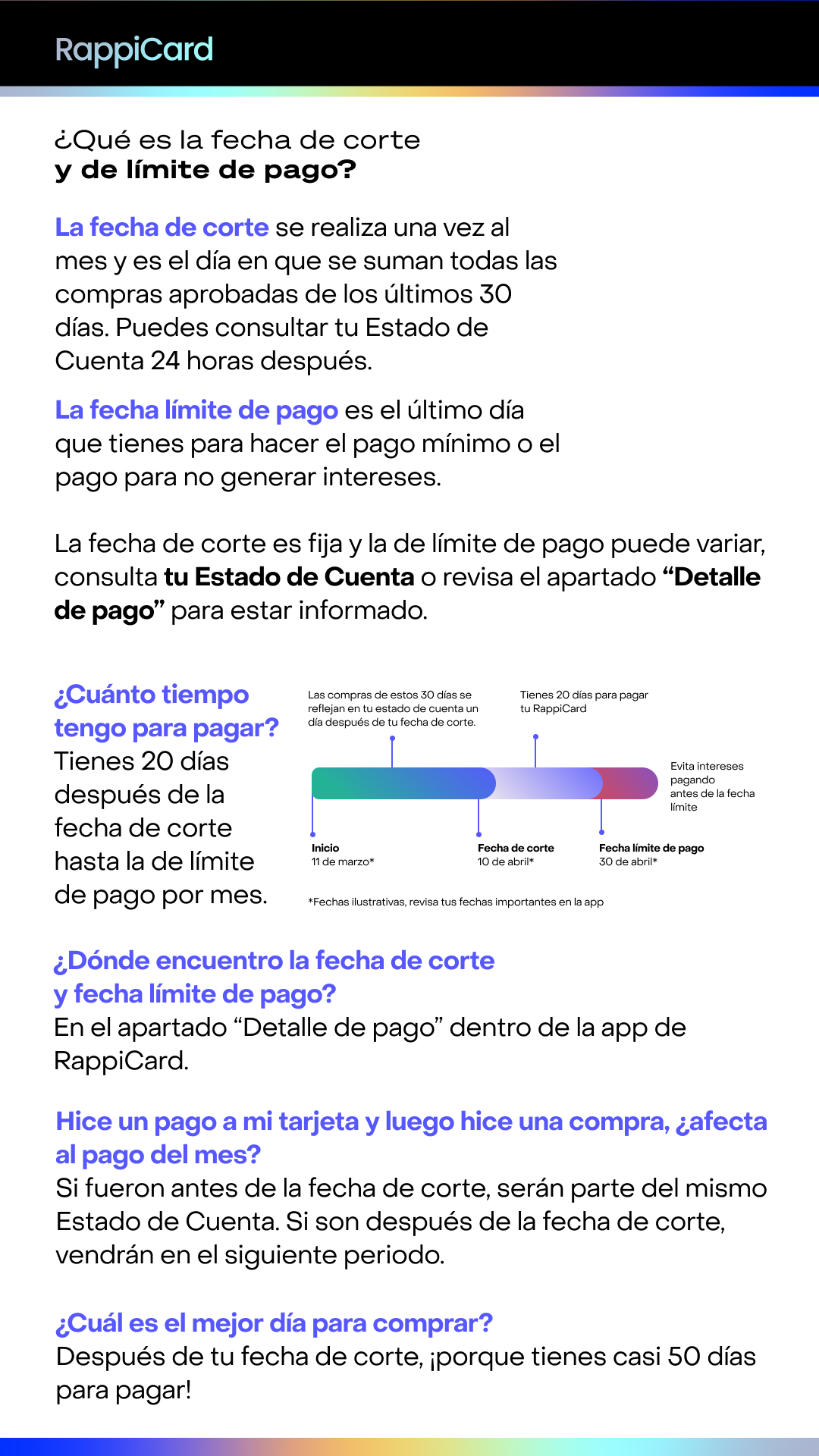

For many, the most common encounter with a "fecha de corte" is through their credit card statements. This date is far more than just a number on a calendar; it's the linchpin of your credit card's billing cycle, directly influencing how and when you pay, and crucially, how much interest you might accrue. Your credit card's "fecha de corte" marks the last day that new purchases, cash advances, and balance transfers are included in your current billing statement. Any transactions made after this date will typically appear on your *next* statement. This means that your statement balance, which you are then obligated to pay, is calculated based on all activity up to and including the "fecha de corte." Understanding this date is vital for several reasons. Firstly, it dictates the length of your interest-free grace period. If you pay your statement balance in full by the payment due date (which is usually 20-25 days after the "fecha de corte"), you typically avoid paying interest on your purchases. Secondly, it helps you plan your spending. If you make a large purchase just before your "fecha de corte," it will appear on your current statement, and you'll need to pay it off relatively soon. If you wait until just after the "fecha de corte," that same purchase won't be due until the following month, giving you more time to manage your cash flow. As experts in financial management often emphasize, knowing the difference between your "fecha de corte" and your payment due date is key to avoiding surprises and managing your finances like a true expert. BBVA Mexico, for instance, highlights the importance of understanding your credit card's cut-off date to navigate your financial landscape effectively.Cut-Off Date vs. Payment Due Date: The Crucial Distinction

While closely related, the "fecha de corte" and the payment due date are distinct and serve different purposes. * **Fecha de Corte (Cut-Off Date):** This is the end of your billing cycle. All transactions posted to your account up to this date are compiled into your current statement. * **Fecha de Pago (Payment Due Date):** This is the deadline by which your credit card payment must be received by the issuer to avoid late fees and interest charges. It typically falls 20-25 days after the "fecha de corte." Failing to distinguish between these two dates is a common pitfall that can lead to unnecessary financial strain. For example, if your "fecha de corte" is the 5th of the month, your statement covers transactions from the 6th of the previous month to the 5th of the current month. Your payment due date might then be around the 30th of the current month. If you only pay the minimum amount or miss the payment due date, interest will be charged on your outstanding balance, often from the date of the transaction, not just from the due date. This is why financial literacy underscores the importance of knowing both dates intimately.Weekend and Holiday Adjustments: What Happens When Your Date Falls on a Non-Business Day?

Life isn't always neatly aligned with banking schedules. What happens if your "fecha de corte" or, more commonly, your payment due date falls on a Sunday or a public holiday? Financial institutions generally have a policy for this. What occurs in these cases is that your payment deadline would be moved to the next business day. So, if your payment deadline falls on a Sunday, it shifts to the following Monday. This is a consumer-friendly practice designed to prevent you from being penalized for circumstances beyond your control, ensuring you always have a business day to complete your payment. While this usually applies to the payment due date, it's a good principle to remember for any critical financial deadline.Strategic Financial Management: Choosing Your Ideal Cut-Off Date

Some credit card providers offer a valuable feature that allows you to choose your "fecha de corte." This flexibility can be a powerful tool for strategic financial management. For instance, with the classic Banamex credit card, you can choose the cut-off date that best suits you, including options for mid-month days. Why would you want to choose your "fecha de corte"? * **Align with Payday:** You can set your cut-off date to fall shortly after your payday. This ensures that your statement balance is generated when you have funds readily available, making it easier to pay in full and avoid interest. * **Optimize Grace Period:** By strategically placing your cut-off date, you can maximize your interest-free grace period, especially for large purchases. If you know you'll have a big expense, making it just after your chosen "fecha de corte" gives you almost two full months before that specific transaction's payment is due. * **Simplify Budgeting:** A consistent and predictable "fecha de corte" that aligns with your other financial cycles can simplify your monthly budgeting process, allowing for better cash flow management and reduced financial stress. This level of control over your billing cycle empowers you to use your credit card more effectively, turning it from a potential debt trap into a powerful financial tool.The "Fecha de Corte" in Immigration Cases: Your Legal Lifeline

Beyond finance, the concept of a "fecha de corte" takes on an even more critical, life-altering dimension in immigration proceedings. Here, it refers to your immigration court hearing date – a non-negotiable deadline that demands your presence and preparation. Missing this date can lead to severe consequences, including an order of deportation or removal in absentia. For anyone involved in immigration proceedings, knowing and understanding your "fecha de corte de inmigración" is paramount. The process of obtaining and verifying this information is crucial. You are encouraged to provide the details of your case and request information about your immigration court date. If you have an immigration attorney, it is imperative to ask them for information about your appearance dates and any changes to your case. An attorney can access your case details and provide authoritative guidance.Checking Your Immigration Court Date: Official Channels and Resources

In the United States, several options are available to verify an immigration court hearing date, ensuring individuals can stay informed about their legal obligations. The Executive Office for Immigration Review (EOIR) provides automated systems designed for this purpose. One of the primary methods is the **Automated Immigration Court Information Line (EOIR)**. This automated system is available 24 hours a day, 7 days a week, providing round-the-clock access to crucial case information. To use this system, you typically need your Alien Registration Number (A-Number). Once connected, you can press "1" to find out when your next immigration court appearance is scheduled. The system will then provide you with the date and time of the hearing. Additionally, it will inform you of the type of hearing you have been scheduled for, as well as the judge assigned to your case. Crucially, it will also provide you with the address of the immigration court so you can attend on the agreed-upon day. It's important to note that the information about the case that appears in this automated system is provided solely for your convenience. While incredibly useful, the official documents issued to you or your representative by the immigration court or the Board of Immigration Appeals are the *only* official documents related to your case. Always cross-reference information obtained through automated systems with official written notices. The automated case information system explicitly states, "Welcome to the automated case information system. The following information relates to the primary case only. Please contact your local court if you need bond hearing information." This underscores the need for direct contact for specific details or complex inquiries. The Executive Office for Immigration Review (EOIR) website also offers automated case information, including details about your next scheduled hearing, information on motions and judicial decisions, and data regarding cases before the Board of Immigration Appeals and the court itself. You can check the status of your immigration case through this automated information system. For specific programs, such as the Family Group Legal Orientation Program (FGLOP) in certain cities, direct contact is advised for detailed information.The Role of Your Immigration Attorney: Your Guide Through the Legal Maze

If you are represented by an immigration attorney, they are your most reliable source of information regarding your "fecha de corte" and any developments in your case. Attorneys have access to specialized systems and direct lines of communication with the courts that are not available to the general public. They can often receive updates more quickly and interpret complex legal notices. Your attorney can access your case details, ensuring you are always informed about your appearance dates and any changes to your case. They are also responsible for filing necessary documents and representing your interests in court. Relying on your attorney for these critical dates is not just convenient; it's a fundamental aspect of effective legal representation.Official Documents and Information: The Sole Source of Truth

While automated systems and attorney communications are invaluable, the ultimate authority on your immigration "fecha de corte" and case status lies with the official documents issued by the immigration court or the Board of Immigration Appeals. These documents, such as Notices to Appear (NTAs) or hearing notices, are the only official character related to your case. Always keep these documents safe and refer to them for the most accurate and legally binding information. Any discrepancy between an automated system and an official document should be immediately clarified with your attorney or the court. The information on your case, such as the date of your next scheduled hearing, is available on the website of the Executive Office for Immigration Review (EOIR). However, this online information is for convenience, and the physical documents are the official record.Why Understanding "Fecha de Corte" Matters: Financial Health and Legal Compliance

The importance of understanding and actively managing your "fecha de corte" cannot be overstated. Whether it pertains to your credit card or an immigration case, these dates are pivotal for your financial health and legal compliance. In the financial realm, a clear grasp of your credit card's "fecha de corte" allows you to: * **Avoid Unnecessary Interest:** By paying your balance in full before the due date, which is dictated by the cut-off date, you can leverage the interest-free grace period. * **Prevent Late Fees:** Missing a payment due date (derived from the cut-off date) incurs late fees, which add up quickly and can negatively impact your credit score. * **Maintain a Healthy Credit Score:** Consistent on-time payments, facilitated by understanding your billing cycle, are a cornerstone of a strong credit history, opening doors to better loan rates and financial opportunities. * **Budget Effectively:** Knowing when your statements close helps you plan your expenses and ensure funds are available when payments are due. In the legal arena, particularly for immigration, the "fecha de corte" is a matter of profound legal consequence: * **Preventing Deportation/Removal Orders:** Missing an immigration court date can result in an order of removal in absentia, meaning you are ordered deported without even being present. This is a severe outcome that can have lifelong implications. * **Ensuring Due Process:** Being present at your scheduled hearings allows you to present your case, provide evidence, and exercise your legal rights. * **Avoiding Delays and Complications:** Missing dates or failing to provide required information on time can significantly delay your case, leading to prolonged uncertainty and increased legal costs. * **Maintaining Legal Status:** For those seeking or maintaining legal status, adherence to all court dates and deadlines is critical to the success of their application or defense. In both scenarios, the "fecha de corte" acts as a critical checkpoint. It's a reminder that proactive management and attention to detail are not just good practices but essential safeguards for your future.Expert Tips for Managing Key Dates

To effectively manage your "fecha de corte" and other critical deadlines, consider these expert tips: 1. **Calendar Reminders:** Set multiple reminders on your digital calendar (phone, computer) for both your credit card "fecha de corte" and payment due date. For immigration, set reminders well in advance of your court date. 2. **Automate Payments (with caution):** For credit cards, consider setting up automatic payments for at least the minimum amount, or ideally, the full statement balance. Always ensure you have sufficient funds in your account. 3. **Regularly Check Statements/Case Status:** Don't wait for a reminder. Regularly review your credit card statements and, for immigration cases, periodically check the EOIR automated system or consult with your attorney. 4. **Communicate with Your Bank/Attorney:** If you anticipate difficulty making a payment or have questions about your case, contact your bank or attorney immediately. Early communication can often prevent bigger problems. 5. **Keep Records:** Maintain a file (digital or physical) of all your credit card statements and, crucially, all official immigration documents. These records are invaluable for verification and dispute resolution. 6. **Understand the Grace Period:** For credit cards, truly grasp how your grace period works in relation to your "fecha de corte" to avoid paying unnecessary interest. 7. **Seek Professional Advice:** For complex financial situations or any immigration matter, always consult with a qualified financial advisor or immigration attorney. Their expertise is invaluable.Conclusion: Empowering Yourself with Knowledge

The "fecha de corte," while seemingly a simple date, holds immense power over your financial stability and, for some, your legal future. From dictating your credit card billing cycles and payment deadlines to marking crucial immigration court appearances, understanding and proactively managing this concept is non-negotiable. We've explored how this critical date functions in both financial and legal contexts, highlighting its direct impact on your well-being. By internalizing the difference between your cut-off date and payment due date, leveraging options to choose your preferred billing cycle, and diligently verifying your immigration court dates through official channels and legal counsel, you empower yourself with knowledge. This understanding allows you to avoid costly mistakes, maintain a healthy financial standing, and navigate complex legal systems with confidence. Don't let these crucial dates catch you off guard. Take control, stay informed, and manage your "fecha de corte" like the expert you now are. What's your experience with managing your "fecha de corte"? Share your tips or questions in the comments below! If this article helped clarify these important concepts for you, consider sharing it with friends and family who might also benefit. For more insights into financial literacy and legal guidance, explore other articles on our site.

¿Qué es la fecha de corte y de límite de pago?

Feminanciera - Conocer la fecha de corte y fecha limite de...

Fecha de corte | Deel